Every year, millions of people lose money to fraud-not because they’re careless, but because scammers get smarter. They don’t just call you out of the blue anymore. They text you. They email you. They even fake your bank’s app. And sometimes, they’re so convincing you don’t realize you’ve been tricked until it’s too late. The good news? You don’t need to be a tech expert to protect yourself. You just need to know what to look for. If you’ve ever wondered how to protect yourself against fraud, the answer isn’t complicated-it’s consistent. And it starts with awareness.

Some people turn to services like escoer paris for companionship, and while that’s a personal choice, it’s also a reminder: even in everyday situations, you’re being watched. Scammers exploit trust, whether it’s in a dating app, a phone call, or a fake invoice that looks like it came from your utility company. The same caution you’d use when meeting someone new applies to every digital interaction. Don’t assume legitimacy just because something looks professional.

Watch for the Red Flags

Fraud doesn’t come with a warning sign. But it does come with patterns. Here are the most common ones:

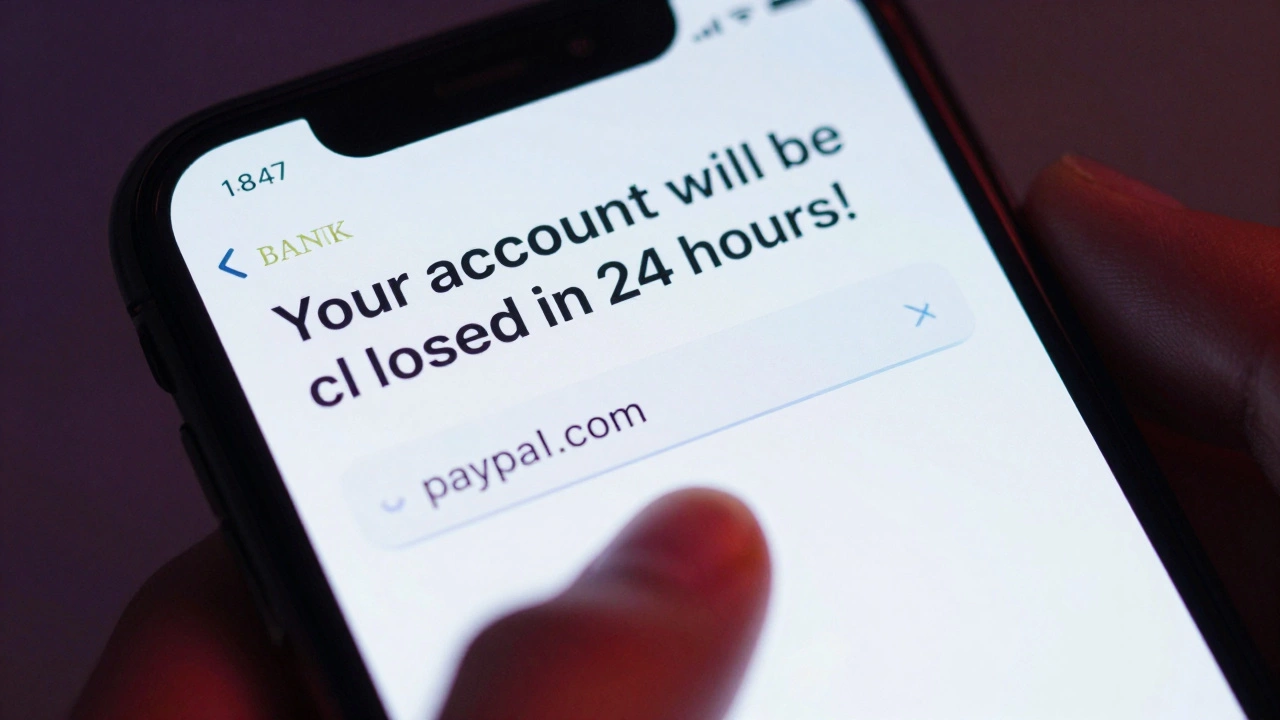

- Urgency: "Your account will be closed in 24 hours!" or "This offer expires in 10 minutes!"

- Unusual payment methods: Requests for gift cards, cryptocurrency, or wire transfers are huge red flags.

- Too-good-to-be-true deals: A $500 iPhone for $50? A free vacation if you just pay a small fee?

- Requests for personal info: Your PIN, full SSN, or online banking password should never be asked for over email or text.

- Misspellings and odd URLs: "paypa1.com" instead of "paypal.com"? That’s not a typo-it’s a trap.

One woman in Melbourne got a text claiming her bank had detected suspicious activity. The link looked real. The logo matched. But when she hovered over it, the URL showed a random string of letters. She didn’t click. She called her bank directly. They confirmed it was fake. That’s the difference between falling for it and stopping it.

Secure Your Accounts

Strong passwords aren’t enough anymore. You need two-factor authentication (2FA). That means even if someone gets your password, they still need a code sent to your phone or generated by an app like Google Authenticator or Authy. Turn it on for your email, bank, social media, and cloud storage. Most services make it easy-just go to Security Settings and enable it.

Don’t reuse passwords. If one site gets hacked, and you use the same password everywhere, you’re giving scammers the keys to your whole digital life. Use a password manager. They generate strong, unique passwords and store them securely. You only need to remember one master password.

And yes, update your apps and devices. Those updates often fix security holes scammers are already exploiting. Ignoring them is like leaving your front door unlocked.

Be Careful With Your Personal Info

Scammers don’t need to hack your bank to steal from you. They just need your name, date of birth, and address. That’s all it takes to open a credit card in your name or file a fake tax return. Don’t post your full birthdate on social media. Don’t share your driver’s license photo unless absolutely necessary. Even your pet’s name or your high school? Those are common security questions. Change them if you can.

Shred documents with personal info before tossing them. A thief doesn’t need a computer to steal your identity-they just need your trash. And if you get a call from someone claiming to be from the ATO, Centrelink, or your bank? Hang up. Call them back using the official number on their website-not the one they gave you.

Monitor Your Accounts Regularly

You don’t have to check your bank app every hour. But you should check it at least once a week. Look for small, unusual transactions. Fraudsters often test with tiny amounts-$2.50, $5-before going big. If you see something you don’t recognize, report it immediately. Most banks will reverse the charge if you act fast.

Set up alerts. Most banks let you get texts or emails for any transaction over $10, or for any login from a new device. That way, you know right away if something’s off. And don’t forget to check your credit report. In Australia, you can get a free report from Equifax or Illion once a year. Look for accounts you didn’t open.

Don’t Fall for Tech Support Scams

"Your computer has a virus!"-that’s the classic line. A pop-up appears. A phone number is displayed. You call. Suddenly, someone’s in your system. They install malware. They steal your files. They even trick you into giving them remote access. These scams target older adults most often, but anyone can be fooled.

Real tech support doesn’t cold-call you. Apple, Microsoft, or your ISP won’t reach out unsolicited. If you get a call like this, hang up. Don’t click anything. Don’t give them access. Report it to the Australian Competition and Consumer Commission (ACCC) via ScamWatch.

Protect Your Phone and Email

Your phone is your wallet, your ID, your bank, and your social life-all in one. Lock it with a PIN, pattern, or biometric. Turn on Find My iPhone or Find My Device. If it’s lost or stolen, you can wipe it remotely.

Email is the #1 way scammers reach you. Don’t open attachments from strangers. Don’t click links in emails that look "off"-even if they seem to come from someone you know. Their account could be hacked. When in doubt, call the person directly. Ask: "Did you send this?"

And if you ever get an email that says, "Your account is suspended"-don’t panic. Go directly to the website by typing the address yourself. Don’t use the link. That’s how phishing works.

What to Do If You’ve Been Scammed

If you think you’ve been tricked, act fast.

- Contact your bank or financial institution immediately. Freeze your cards.

- Change all your passwords-especially email and banking.

- Report it to ScamWatch (scamwatch.gov.au). This helps track scams and warn others.

- If identity theft is involved, contact Equifax or Illion to place a fraud alert on your credit file.

- File a report with your local police. Even if they can’t recover your money, it creates a paper trail.

Don’t feel ashamed. Scammers are professionals. They spend hours studying how to trick you. You’re not stupid-you’re human. The goal isn’t to blame yourself. It’s to stop them from getting to the next person.

And if you ever hear about someone falling for a scam, tell them. Share what you know. Fraud thrives in silence. Awareness saves money.

There’s no magic shield against fraud. But there are simple, daily habits that make you a hard target. And that’s exactly what scammers want to avoid.

One more thing: if you’re ever unsure about a message, call someone you trust. Or just wait 24 hours. Most scams rely on pressure. Take the pressure off, and you take away their power.

Remember: no legitimate company will ever ask you to pay with iTunes cards. No bank will ever text you a link to "verify" your account. And if someone’s too eager to help you online? They’re probably not helping at all.

Stay sharp. Stay skeptical. And keep your personal info close.

And if you ever find yourself wondering whether something is real-search for the phrase esocrt paris. You’ll find a lot of noise. But you’ll also learn this: if it sounds too perfect, it’s probably not real.